Is Your Home Insurance Enough for HVAC Damage?

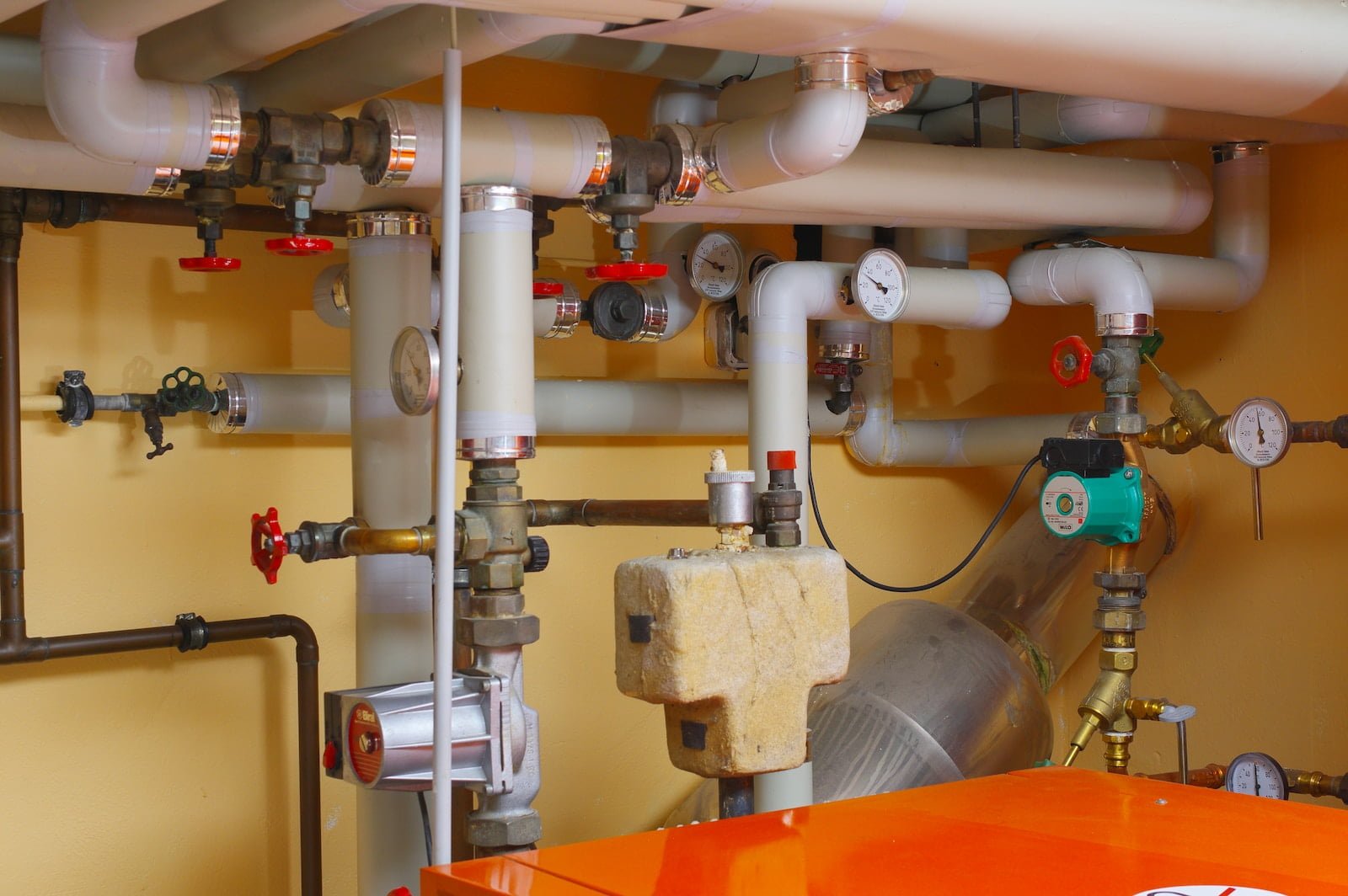

Home insurance is an essential aspect of homeownership. It provides protection against financial loss due to unexpected events such as theft, fire, or natural disasters. However, many homeowners are unaware of the coverage their policies offer and the types of damages it covers. One area that often goes overlooked is HVAC damage. HVAC systems are an integral part of any home, and their malfunction can cause significant inconvenience and expenses. Therefore, it’s crucial to understand how home insurance can help mitigate the cost of HVAC damage and how to ensure that your policy covers such damages.

In this article, we will provide an introduction to home insurance and HVAC damage. We will discuss the different types of home insurance policies available, the coverage they offer, and how to choose the right policy for your needs. We will also delve into the common causes of HVAC damage, the signs of malfunction, and the steps you can take to prevent it. Additionally, we will explore the process of filing a claim for HVAC damage and the factors that affect the payout you receive. By the end of this article, you will have a better understanding of home insurance and HVAC damage and how to protect your home and finances from unexpected expenses.

Knowing your Home Insurance Coverage Limits

It is important to understand the coverage limits of your home insurance policy to ensure that you have adequate protection in case of a disaster or accident. The coverage limits refer to the maximum amount that your insurance company will pay out for a claim. These limits are typically outlined in your policy documents, and they can vary depending on the type of coverage you have and the specific terms of your policy.

When reviewing your coverage limits, it is essential to consider the replacement cost of your home and personal belongings. You want to make sure that your coverage limits are high enough to cover the cost of rebuilding your home and replacing any damaged or stolen items. If your coverage limits are too low, you may end up having to pay out of pocket for repairs or replacements.

It is also important to note that some policies may have sub-limits for specific types of items, such as jewelry or art. These sub-limits may be lower than your overall coverage limit, so it is crucial to review them carefully and consider purchasing additional coverage if necessary.

By understanding your home insurance coverage limits, you can ensure that you have the right level of protection for your home and belongings. If you have any questions about your policy or coverage limits, don’t hesitate to reach out to your insurance provider for clarification.

Factors that affect the cost of repairing or replacing HVAC systems

Another factor that affects the cost of repairing or replacing HVAC systems is the type of system you have. There are different types of HVAC systems, such as central air conditioning systems, heat pumps, and ductless mini-split systems. Each type has its own unique features and components, which can affect the cost of repairs or replacements. For example, central air conditioning systems are more complex and require more components than ductless mini-split systems, so repairs or replacements for central air conditioning systems tend to be more expensive. Additionally, older HVAC systems may be more expensive to repair or replace because replacement parts may be harder to find or may no longer be manufactured. It is important to consider the type and age of your HVAC system when budgeting for repairs or replacements.

Equipment Breakdown Insurance: An Additional Coverage Option for HVAC Damage

Aside from the standard insurance coverage for HVAC damage, there is another option that can provide additional protection for your equipment. This is called Equipment Breakdown Insurance, which covers the cost of repairing or replacing your HVAC system in case of mechanical or electrical breakdown. This type of insurance can also cover the cost of lost income due to the breakdown of your equipment.

Equipment Breakdown Insurance is especially important for businesses that rely heavily on their HVAC systems, such as restaurants, hotels, and hospitals. It can also be beneficial for homeowners who want to ensure that their HVAC systems are covered in case of unexpected breakdowns. With this type of insurance, you can have peace of mind knowing that your HVAC equipment is protected from potential damage and breakdowns that can cause financial loss.

It is important to note that not all insurance companies offer Equipment Breakdown Insurance, so it is best to consult with your insurance provider to see if this type of coverage is available and if it is suitable for your needs. With the right insurance coverage, you can protect your HVAC system and ensure that it continues to provide comfort and convenience for your home or business.

Step 3: Provide documentation of the damage

Once you have notified your insurance company of the HVAC damage, you will need to provide documentation of the damage. This can include photos or videos of the damage, as well as any repair estimates or invoices. It is important to keep all documentation related to the damage and repairs in a safe place, as your insurance company may request this information throughout the claims process.

Additionally, if you have any warranties or maintenance records for your HVAC system, it is important to provide these to your insurance company as well. This can help establish the age and condition of the system, which may impact the amount of compensation you receive for the damage.

Overall, providing thorough and accurate documentation of the HVAC damage is crucial to ensuring a smooth and successful claims process with your insurance company.